Repayment

Definition

A repayment represents the payment received from a debtor or client to settle a financed receivable or invoice.

Repayments must be received by the loan due date; otherwise, the loan is considered PAST_DUE, and late fees will be applied.

Repayments must be reconciled so that the loan is considered as repaid (please refer to the Reconciliation section).

Repayment process

- Proceed to Repayment You or the debtor repay us on the communicated bank account for the right currency (available in your dashboard > settings > repayment destinations).

- Reconciliation We reconcile the Repayment with Loans. This can be done automatically or manually with your help (see: Reconciliation).

- Loan Settlement

Once the repayment is reconciled, the loan transitions to

REPAIDif the repayment amount was sufficient. The repayment date used for late fees computation is the date the repayment was received (not the date of reconciliation). - Redirection We redirect the extra amount we received to your platform (see: Redirection).

Repayment Methods

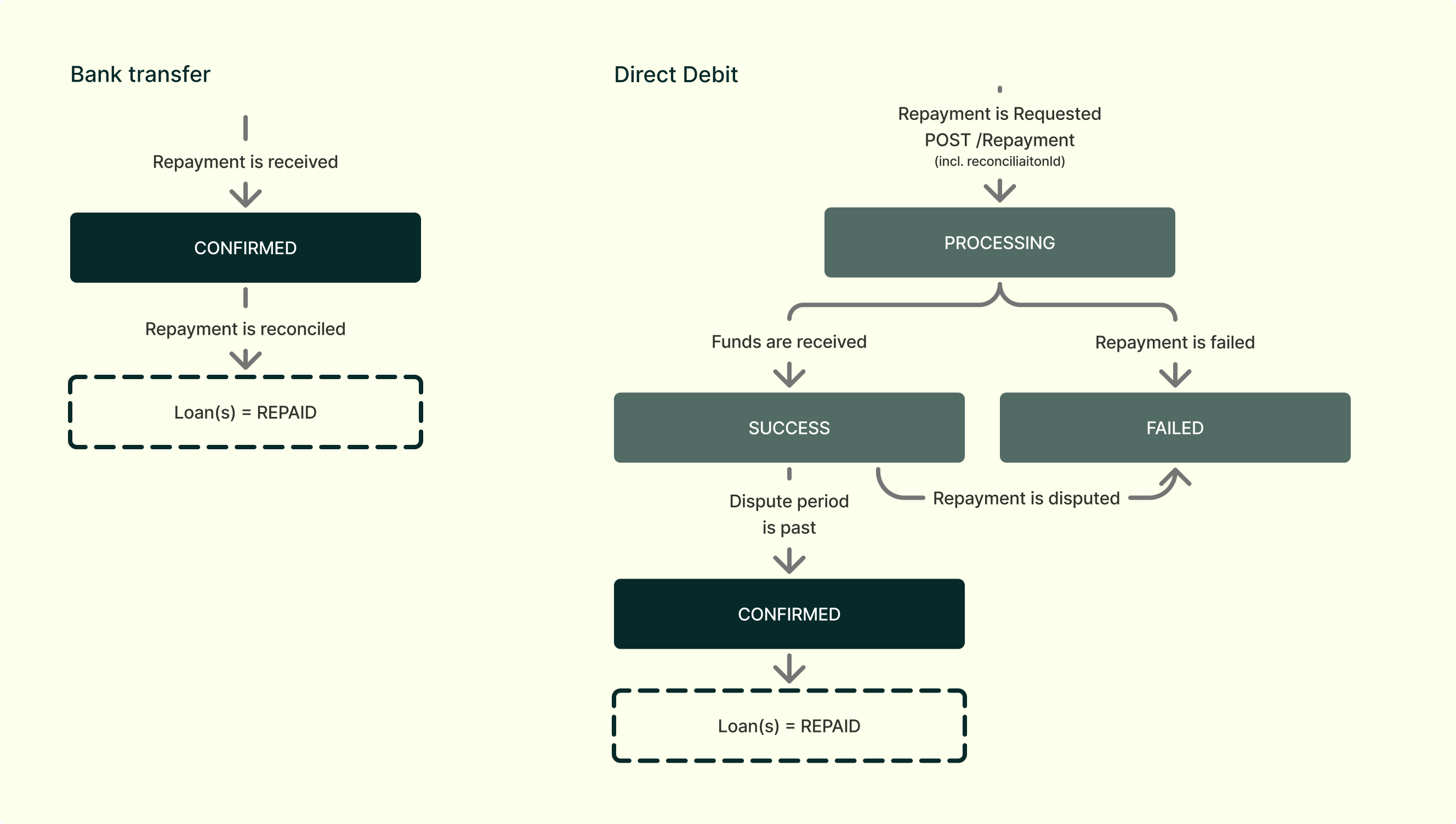

Bank transfer

A loan can be repaid via bank transfer using the repayment destination provided to you (available in your dashboard under Settings > Repayment Destinations).

Please include the repaymentReference in the transfer label to help reconciliation (see: Reconciliation).

SEPA Direct debit

Activating SEPA Direct Debit is subject to eligibility. Please contact your dedicated Key Account Manager for more information.

A loan can be repaid via automatic debit.

To do so, you will have to collect a Debit Mandate signed by the debtor, allowing Aria to debit funds from the debtor's account. Currently, we support only B2B SEPA Direct Debit mandates.

How to proceed:

- Create a

RepaymentMethodfor the debtor repaying us (including the signed mandate). - Notify your client 14 days before the repayment date (or as agreed) that a debit will be processed.

- Create a

Repaymenton the repayment date, specifying the repaid loans.

When the funds are received and the repayment is CONFIRMED, related loans are REPAID (following the logic "earliest created loans are repaid first").

Note that repayment is considered as CONFIRMED after the dispute period is past.

Typical dispute period lasts 3 days for a B2B SEPA Direct Debit.

Repayment status

PROCESSING: The repayment request is registered but not yet processed.SUCCESS: The repayment request has been processed successfully and funds are received, but the transaction can still be disputed.CONFIRMED: The funds are received and the transaction cannot be disputed. Reconciled loans are considered repaid. (Note: For bank transfers, all received repayments immediately transition to this status.)FAILED: The debtor's bank refused the payment (e.g., insufficient funds) or the payment was disputed within the dispute period. The repayment will be retried if possible, or our team we'll contact you.

Failure reasons

| Failure Code | Description |

|---|---|

DEBTOR_BANK_INSUFFICIENT_FUNDS | The debtor's bank account has insufficient funds. |

MANDATE_INVALID_IBAN | The mandate's IBAN is invalid |

MANDATE_MISSING_INFO | A required piece of information is missing from the mandate. Please ensure the debtor's name, address, and IBAN are filled in, and that the mandate is signed. |

MANDATE_UNREACHABLE_IBAN | The mandate's IBAN is not reachable for the selected scheme. Please verify that the debtor's bank supports this payment scheme. |

DEBTOR_REFUSAL | The debtor or their bank has refused or revoked the mandate. |

DEBTOR_BANK_ACCOUNT_CLOSED | The debtor's bank account is closed or does not exist. |

DEBTOR_REFUND | The debtor or their bank has requested a return or refund of the transaction. |

TECHNICAL_ERROR | An error occurred on our side or with our PSP. |

OTHER_ERROR | Other or undefined execution failures. |

Updated 3 months ago