Invoice

Definition

The Invoice object represents a sales invoice (document issued and sent to a debtor/client).

This is the main piece of evidence Aria needs to validate your advance payments and/or process repayments.

To make a payment with Aria, you have two options:

Option 1 - standard workflow

You will be asked:

- to create an

Invoiceby uploading and filling information - then to create a

Loanrepresenting the requested advance payment.

Option 2 - alternative workflow, in case no Invoice is issued yet when you request the advance payment.

You will be asked:

- to create a

Receivableby uploading and filling information - to create a

Loanrepresenting the requested advance payment - to create an

Invoicelater on so that we can process repayments

For more details regarding option 2 see Receivable.

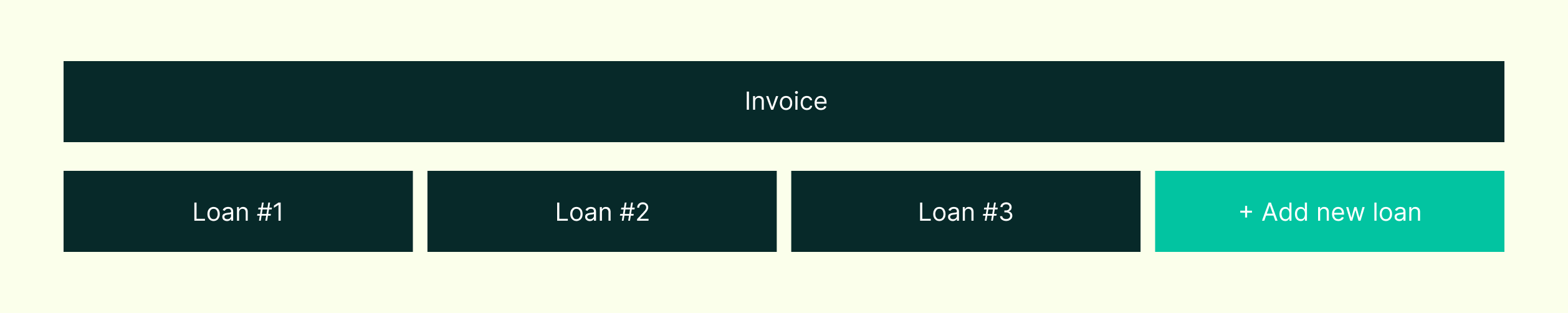

An Invoice can be attached to many Loans.

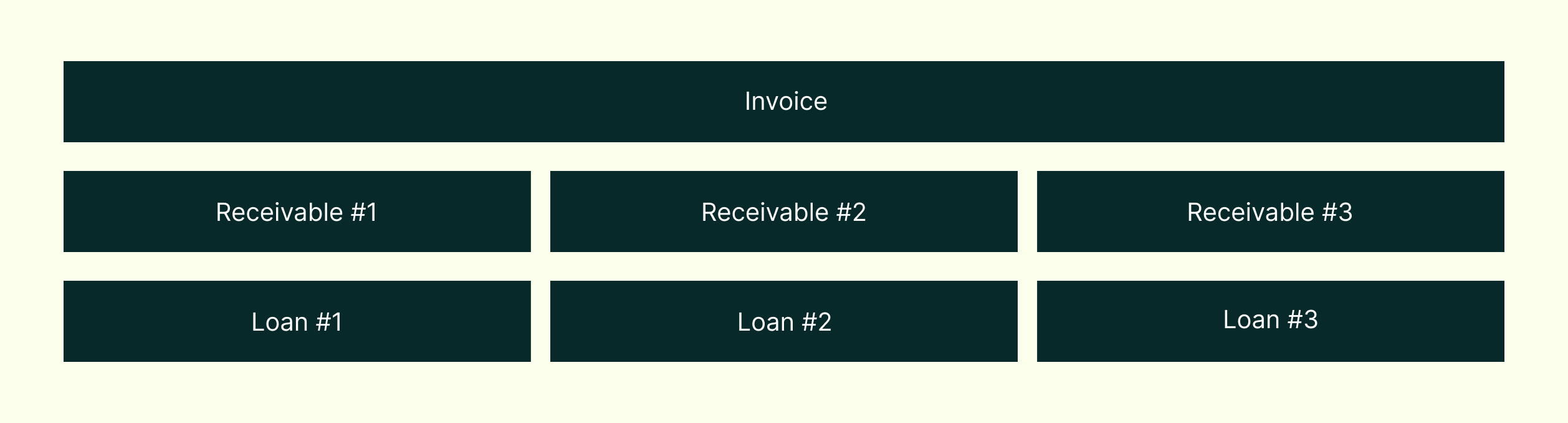

An invoice can be attached to many Receivables.

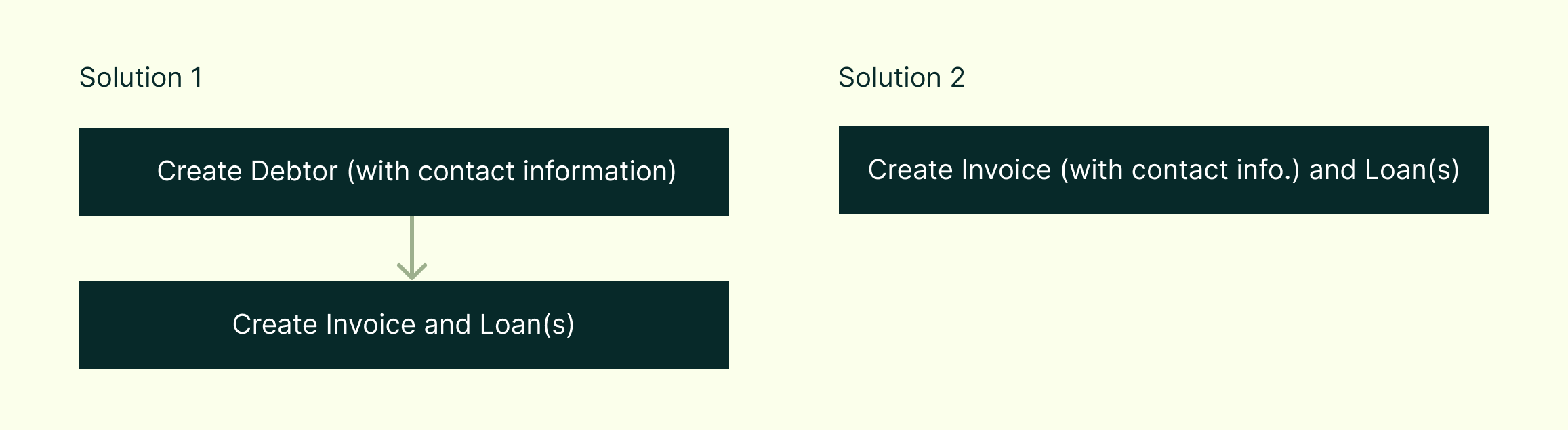

Debtor contact

Each uploaded invoice must be associated with a corresponding Debtor. For the purpose of debt collection, we need you to provide the Debtor's contact information. This can be done either by creating a Debtor before uploading the invoice, or by providing their contact information at the time of invoice creation.

In the first solution, all of your contact information would be stored within the Debtor object, which can be associated with multiple invoices. On the other hand, the second solution involves storing all the necessary information for each invoice within the invoice object itself.

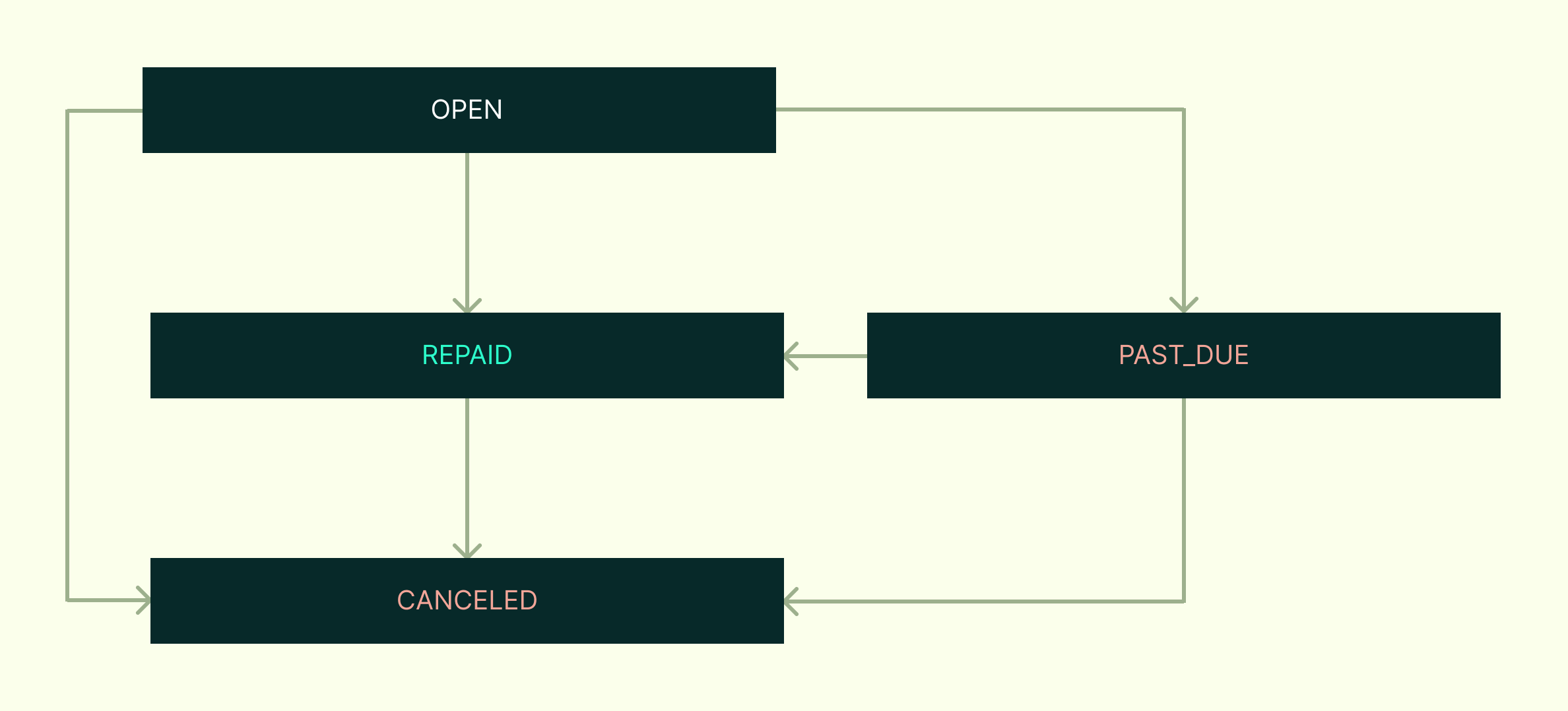

Invoice status

We provide 4 status:

OPEN: the Invoice has been createdREPAID: all loans related to this Invoice have been repaidPAST_DUE: at least 1 loan related to this invoice has not been repaid yet and the due date has passedCANCELED: the invoice has been canceled by issuing a credit-memo

Invoice validation

Based on your setup, invoices may need to be validated by the Debtor. You have two options:

- Collect the invoice validation yourself and provide the proof (including attachment) through our invoice validation endpoint (or through the dashboard in one of its future version).

- Rely on us to collect the invoice validation. We can manage it for you by sending automated emails to the Debtor.

This process will be defined during onboarding.

Even if you provide proof of a validated invoice, we may occasionally send our own validation email to the Debtor if needed, and may temporarily hold the loan.

Invoice cancelation

After an Invoice is created, and before it is paid, it can happen for various reasons (overbilling, billing errors, …) that you need to cancel the initial invoice and re-create one or several new invoices to replace the initial one.

The way of proceed to invoice cancelation differs depending on the financing flow you implemented:

- if you are in the option 1 where Loans are created based on an Invoice:

- if the Loan is

CREATED,BLOCKEDorACCEPTEDyou can cancel the Loan, then create a new Loan for a new Invoice. - otherwise you will have to repay the initial loan and create a new invoice and new loans if it requires new advance payments.

- if the Loan is

- if you are in the option 2 where Loans are created based on a Receivable:

- you must create the new Invoice(s) that is going to replace the former one and link it to the receivable(s) (

POST /invoices), - then cancel the initial Invoice by creating a Credit-Memo (

POST /credit-memos)

- you must create the new Invoice(s) that is going to replace the former one and link it to the receivable(s) (

A Credit-memo (or credit note) is a document sent to the debtor/client that reduces the amount the buyer owes on previously issued invoices. A Credit-memo is required when you cancel an invoice that was previously linked to a financed loan.

Rules

- An Invoice has an unique

invoiceNumber, so you will not be able to upload two Invoices with the sameinvoiceNumber. If you create an Invoice using an invoice number that already exists, the existing Invoice will be updated with the new information you provide. - An Invoice may be updated if it has no Loan linked to it or if Loans are in

CREATEDorREFUSEDstatus. - An Invoice may be deleted if it has no Loan linked to it.

- An Invoice and its Loans must be repaid before the

dueDate. For more details, see Repayment.

Additional rules, specific to Option 2 (in case you create the Invoice for a financed Receivable):

- The Invoice

owner,debtorandcurrencyvalues must be the same as for Receivable. - The Invoice

paymentTermTypemust be the same as the ReceivableexpectedInvoicePaymentTermType. - The Invoice

repaymentPeriodmust be the same as the ReceivableexpectedInvoicePaymentTerm

Updated 7 months ago